Illustration by Margaux Savey / Momkai

Back in 2004, I helped one of the early online environmental “blogs” undertake a big technical upgrade. At the time, this site had a staff of 10 people and their email newsletter list had about 60,000 subscribers. I remember thinking that was a sizeable list at the time, and much later learned how important it was to their nonprofit business model.

Three years later I checked back in with them. They’d moved into a new office — a much bigger space to accommodate a staff that had grown to more than 20. I asked about their email newsletter list size: it was now 600,000+ subscribers strong, a growth of 10x. Their annual revenue, unsurprisingly, was much larger too.

In the years that followed, I kept a close eye on their business model because I felt like it provided a glimpse into the future of internet publishing and — more importantly — the strategies and tactics that might lead to sustainability for online journalism.

Case in point: this “blog” — Grist.org — has been publishing for 20 years now, employs 35 people and generates more than $3 million in annual revenue. In an industry where there’s stiff competition from corporate competitors like Discovery Communications and Gizmodo Group, they’ve become one of the most renowned voices in environmental media for their brand of “Gloom and doom with a sense of humor.”

But the one detail of their story that I obsessed about the most was the exponential growth of their email list. And how they did that has lessons applicable to many news publishers.

In addition to helping the organization spread its coverage about climate change and environmental advice, their email list also drove substantial growth in revenue from donors, as well as sponsorship and advertising. It also increased the reach of their stories and engagement from their community.

There were many factors that drove that growth, but the one that surprised me the most was paid subscriber acquisition.

Two Facebook ads run by Grist.org that the company posted with the goal of growing their newsletter list.

Here’s another fact that might surprise you: Today, many savvy digital-first newsrooms have seen this opportunity, too, and are investing thousands of dollars a month — sometimes tens of thousands — into paid acquisition campaigns.

And yet the second fact that surprised me all those years ago and still continues to is that so many publishers are choosing not to invest in this area, or simply aren’t even aware of it as an opportunity to grow their audience and membership. There are several reasons for this (detailed below), but the top two challenges are “resources to assist with campaign planning” and “available budget to invest.”

These challenges are particularly acute for news startups where it’s essential that these efforts are undertaken before their launch funds run out. It could quite literally be the difference between a journalism organization existing or not.

In this first report and in subsequent pieces I’ll share what I’m seeing as I attempt to answer the question: Can publishers who seek to grow their membership invest in paid lead acquisition tactics and predict with strong confidence the rate of return on their investment? [Editor’s note: Check out Spending Money to Make Money, Part II: Case Studies of Newsrooms Using Paid Acquisition.]

To answer this question, several organizations have worked together — the Membership Puzzle Project, Pico, and the Lenfest Institute for Journalism — with me, a 20-year veteran of the publishing industry, former CTO of an online news startup, and now entrepreneurship coach for journalists. Together, we’ve asked seven publishers across the United States to experiment with paid acquisition campaigns. These publishers cover a range that includes local news, regional news, and single-subject news. All but one are digital-first publishers:

- Block Club Chicago (subscriptions): Block Club Chicago is a nonprofit news organization dedicated to delivering reliable, nonpartisan, and essential coverage of Chicago’s diverse neighborhoods.

- BoiseDev (membership): BoiseDev is a community-focused journalism organization, bringing business news coverage to the Greater Boise area.

- Brooklyn Eagle (engagement): The Brooklyn Eagle is journalism for curious, creative, and constructive Brooklynites.

- Colorado Sun (membership): The Colorado Sun is a journalist-owned, award-winning news outlet based in Denver but which strives to cover all of Colorado.

- Documented (patronage): Documented is a nonprofit news site devoted solely to covering New York City’s immigrants and the policies that affect their lives.

- The River (patronage): Real news for real people, in the Hudson Valley.

- Sludge (patronage): Sludge produces investigative journalism on lobbying and money in politics.

Now, you have a front row seat to this research. Your questions will help guide where it goes next. And I hope that you’ll take these ideas back to your own newsroom, experiment, and contribute back your results to our growing community of “paid acquisition for news” nerds (you can find dozens of us in the #paidacquisition channel on the Let’s Gather Slack instance).

Let’s get to it, shall we?

The Opportunity for News Publishers and Journalism Funders

There’s an opportunity to simply fund email list growth and to walk away knowing that this is a leading indicator for subscriber, member, and donor growth, as well as increased revenue from sponsorships and advertising.

Larger email lists also mean more people reading an organization’s journalism, more people sharing, and more engagement with polls, surveys, letters to the editor, comments, and more. Email list size is a critical “North Star” metric for many digital-first news publishers, particularly because of the correlation between list size and audience revenue, a topic that we’ll explore below.

As demonstrated by government grant programs in Canada, this strategy is fairly obvious. However, it is not “sexy” per se and appears to be beneath the consideration of most of the larger journalism-focused foundations in the US. One possible reason for this might be funders’ distaste for operational scaling, something that is fairly common in other industries. But it’s not just the Canadian Government that believes this is a solid strategy. It’s also precisely the way that many venture capital investors work, too: They look for signs of a company’s early traction with users and then invest in helping that company find exponentially more users.

Growth these days is treated as a science with a profession of its own. This professionalization and the internet mean that never has it been easier to find people who might be interested in a product. Long-gone are the days of having to use the “spray and pray” approach offered by direct mail marketing. It’s now possible to micro-target just the right people, with just the right offer, and encourage them to take that first step of creating a relationship with a news brand. From there, it comes down — mostly — to math. A large number of cold leads in one end of the funnel, and a small number of paying customers out the other end … eventually.

And that is the one variable that is, perhaps, the most important thing to note: time.

It takes time to build a membership program, time to design the funnel that potential members will pass through, and time to test each step: to look at the data, to adjust, to iterate, to optimize. Most significantly, it takes time to build the relationship and trust needed to convert cold leads into regular readers, and then into paying community members.

Growth-oriented, tech-savvy funders and investors already understand this. In other industries, this idea isn’t verboten but embraced. I can only hope that the rest of the sector will come to the realization that investing in journalism is a long-term investment, and that underwriting activities like paid subscriber acquisition — activities that lead directly to growth — are far more important than finding the next shiny new thing.

The opportunity is significant: When I informally surveyed 20 American publishers with different coverage areas and list sizes, I found that only half are currently engaged in any kind of paid acquisition activities. And when looking at newsrooms with fewer than seven staffers, a size at which audience growth is often critical to survival, none were actively working on paid acquisition campaigns (more on this below). The majority of newsrooms with a staff of more than 20 staff people were engaged in this work, and yet — in most of those cases — the work was a subset of someone’s job, not a full position unto itself.

Paid Acquisition in a Nutshell

Whether called performance marketing, direct response, or the gag-inducing “growth hacking,” we define paid acquisition for this experiment as any form of paid marketing that seeks permission to contact the person again. Whether that’s by asking directly for an email address, a mobile phone number for SMS engagement, or a social profile for messaging, or indirectly by providing a free product trial, a contest entry, or even an inexpensive sale like a $1 time-limited subscription — as long as a publisher pays to get that information from a potential customer (or member, subscriber, or donor) — we consider those activities “paid acquisition.”

Often, permission to contact the person again would be followed up in the short term with information that provides some value to this new person (whom we’ll now refer to as a lead), such as a no-cost newsletter subscription or a no-cost guide on a frequently read topic. Down the road, the new lead would likely receive information about products or services provided by the publisher, such as a subscription offer, premium membership benefits, a variety of information products, or, in the case of a nonprofit publisher, an appeal for support.

The math is fairly simple and has its roots in direct-mail marketing from long ago. Once a publisher has enough information to calculate the average lifetime value of a customer (my fellow MPP researcher Joe Amditis has written more on this topic as it relates to membership), it becomes relatively straightforward to determine how much to invest in acquiring a new customer. The objective is to spend less than the estimated customer lifetime value minus cost of service. Be sure to include hard costs, as Alexandra Smith described in this article by WhereBy.Us’ Anika Anand.

From there, a savvy publisher will experiment to determine the average rate at which new leads convert into paying customers, thus answering the sometimes-tricky question of “how much should I pay to acquire a new lead?”

Both of these variables, average customer lifetime value, and average customer conversion rate, will vary by the source of the lead. But once a publisher has this data, growth can become more predictable and can justify greater investment.

Anecdotally, I used to spend a lot of time at conferences aimed at the magazine industry. These conferences were filled with direct-mail marketing experts and circulation gurus. Inevitably, a magazine publisher would ask the question, “How many direct mail campaigns should I send to the same mailing list?” And the answer to this question is surprisingly simple: They should keep sending direct mail until they’re paying more for a lead than they might recoup in future revenue (minus costs of producing the product and/or delivering the service).

The same formula holds with paid acquisition. As long as the cost per lead is low enough to predict over a specific period of time, and that revenue from leads that convert into members is likely to be higher than the marketing expense of acquiring all the leads, one should keep investing and work to scale that investment until the formula no longer works.

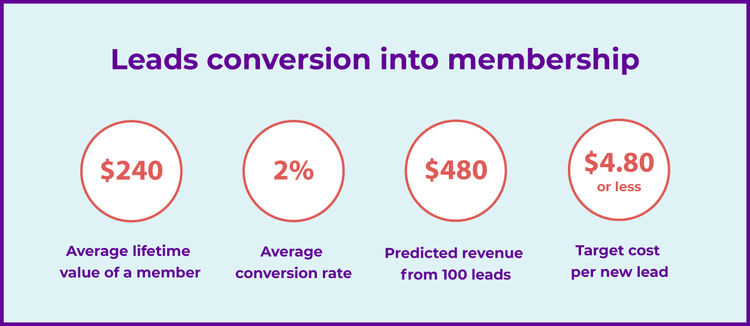

Here’s a simple graphic that puts this plainly:

For example, if 2% of leads convert into paying members, that would mean two new members for every 100 leads. And if those two new members, on average, resulted in $240 each, say, or $10/month for two years, that would result in $480 in revenue. Thus, as long as all the leads were acquired, on average, for less than $4.80/each, the publisher would grow their subscriber or member base and break even on the cash investment (cost of labor is not included in this simplified example). The same would hold true for 1,000 leads and 10,000 leads.

This approach to growing customers is so established at this point that there’s a whole category of software dedicated to helping companies design and visualize their paid acquisition sales funnel, to predict changes in revenue based on what is invested in acquiring new leads, as well as an abundance of tools to help with improving conversion rates. For example, Geru helps to visualize funnels and estimate costs and revenue, services like Unbounce help to build landing pages and improve conversion rates, and products like Ad Espresso help to manage cross-platform campaigns.

Screenshot of a popular “funnel planning” software Geru.

And, beyond software, there’s a whole industry of professionals, agencies, and certifications that have become established brands in the field of growth, performance marketing, and paid acquisition. To avoid sending you down a very large rabbit hole, I’ll simply point you to this free online guide to growth by Julian Shapiro as a good place to start diving deeper, as well as this excellent essay by Aubrey Bergauer on audience development.

Experiments with Paid Acquisition

Even though the math is straightforward and there’s a whole industry dedicated to the science of growth, the question remains: How well does it translate to the world of journalism at large, and journalism membership programs specifically?

To answer that question we teamed up with Pico, a newsroom software company that provides “smart pop-ups and landing pages to turn readers into customers,” and asked several publishers on Pico’s platform if they would be open to experimenting with paid acquisition campaigns and letting us detail the results. Funding by a grant to Pico from the Lenfest Institute covered the hard costs of the acquisition experiments: platform advertising fees and stock photos. These hard costs are a figure that curious publishers will need to think about in calculations toward their own efforts.

The experiment design is relatively straightforward and consistent across most publishers:

- The campaign is always promoting the publisher’s free newsletter. In some cases that’s weekly, in some cases daily. The ad campaign objective is a subscription to the publisher’s newsletter.

- Once subscribed, new leads receive a three-part automated email series. The first message is a simple welcome, the second a short survey, and the third a gentle ask for financial support. The language and length of these emails was kept similar across publishers.

- At the end of the series, I calculate both engagement and conversions across those leads. Specifically, how many opened the email series emails? How many unsubscribed? How many took the survey? How many became a financial supporter?

- Over time, we’ll also be looking at email newsletter engagement and engagement on the publisher’s website.

There are two outliers in the sites in this study. One publisher is experimenting with United States Postal Service (USPS) marketing to potential members in their city. There we’ll be looking at how many people made the leap from postcard to website and eventually to paying members of the site. Another publisher will be testing a different kind of membership ask. In this case, it will be voluntary membership in a locally-focused “insight network” for that city, similar to American Public Media’s Public Insight Network.

These are exciting questions to be asking, and I’m keen to answer them, in part, with data. As is said, “math don’t lie.” And yet math doesn’t always reveal the entire truth either. The limitation of this research is the very short window of time that we’ll be looking at: just a few short months between June 2019 and January 2020, far short of the time necessary to see the full picture.

The Facebook Local News Subscriptions Accelerator Program has been looking at a similar question for just over a year now and recently reported that they’re seeing promising results across the metro newspapers in their program. Specifically, they’ve reported that publishers might “expect to convert five to 10 percent of your email subscribers to paid,” and went on to share that “most Accelerator publishers saw that range of free newsletter readers converting to paid subscribers.” When I asked Facebook Journalism Project’s Program Manager for accelerators, David Grant, to expand on these findings in terms of how long it took to accomplish that conversion, he clarified that “for all of these titles, it’s taken years.”

What I am hopeful to document objectively, however, are some starting points for publishers that are thinking about this route: what works, and what doesn’t in terms of ad copywriting and images, ad formats, and audience reach. And what to expect in the days, weeks, and months after new leads join a newsletter list. What to expect to pay for new leads across platforms. What to expect in terms of performance. And what signals to look for toward a longer-term outcome of a conversion to paid membership.

Early Results, Promising Signs

With funding through January 2020, it’s still early days for this research. And paid acquisition work requires an investment of time and attention that is challenging for many smaller publishers (more on that below). That said, I’m happy to report out some early results.

We are currently running paid subscriber acquisition campaigns on two platforms, Care2 and Facebook. The aim is to expand on these experiments and to investigate other lead-acquisition platforms, including the earlier mentioned USPS, as well as Google Adwords, LinkedIn, Quora, and Reddit.

Facebook’s “boosted posts,” a form of advertising with the purpose of getting people to react, share, and comment, are a relatively well-known commodity to most publishers. However, many publishers I’ve spoken with outside of our research group are not aware of the key differences between the various ad types that Facebook offers, which currently number more than 10. Our research focuses exclusively on the “Lead” ad type, which optimizes for subscriptions that take place on Facebook directly.

This is unique from the other types of ads that would typically require a publisher to direct the user to a landing page of some kind off of Facebook.

An example of a Facebook “lead” ad.

Care2 is relatively unknown to many publishers. It describes itself as a 21-year-old “network of millions of people around the globe, dedicated to building a better world.” Its core product is essentially an online petition service that is used by anyone from neighbors to global NGOs. The network boasts 45 million users with most of those in the US. To support itself financially, Care2 provides a pay-per-lead campaign service, which is what we’re testing with the publishers in this study. We are testing both issue-focused campaigns (environmental reporting) and geo-targeted (state-wide reporting) campaigns on the platform.

A Care2 petition for Sludge.

To date, these campaigns have delivered thousands of new email newsletter subscribers to some of the participating publishers. And, 12 weeks in, this is what we’re seeing across the subset of publishers who have undertaken Facebook and Care2 campaigns:

- Engagement via open rate: Open rates for the email series range from 26% to 36%, and the average open rate across all emails and all publishers for new leads is 29%. This is higher than the MailChimp-reported industry average for “media and publishing” of 14%.

- Engagement via survey: The rate of new leads who completed the short survey ranged from 2.7% to 7.8%, with an average across publishers of 4.7%.

- Retention and churn: The unsubscribe rate, so far, has been between 0.8% to 6.4%, with an average across emails and publishers of 2.8%. In future updates, we’ll unpack how this compares to industry averages.

We’re also observing a consistent cost per lead of less than $3 across the two platforms we’ve tested. Care2’s pricing is set in advance, unlike Facebook’s, and varies based on how specific the audience criteria is. On Facebook, we’re seeing a range of scenarios play out, in some cases the average cost per lead is consistently below $1, in others it’s between $1.50 and $2.50, and we’ve yet to learn if these costs will stay consistent across tens of thousands of leads.

What we’re also still assessing is the quality of those leads, their engagement with the journalism, likelihood to stay subscribed and, eventually, to convert. Lead quality will likely vary by lead source, as will the cost per lead. For example, platforms like LinkedIn will be more expensive to advertise on, but we might find that they deliver a lead quality that justifies the larger investment. There’s still a lot to learn.

However, if Facebook’s own observations hold true — that news publishers are seeing conversion rates between 5 to 10% from free newsletter subscribers to a paid digital subscriptions and memberships — then these lead acquisition costs are a promising signal for publishers to take note of. At a 5% conversion rate, using the most basic of calculations like the one above, the prediction is that a publisher would generate a tidy 2.5x return on ad spend (ROAS). At 10%, that would jump to a 5x return, a number that would be the envy of many people in publishing and growth science, too.

My own observations from over a decade of working as a staffer and consultant for publishers in South America, North America, and the United Kingdom have led me to be more conservative in my predictions. And, having spent many years managing projects like this at The Tyee, I understand what it’s like to work in a resource-constrained newsroom. My hope is that this research will eventually provide the detailed data necessary for publishers to determine their own estimates of what they can reasonably achieve within a certain timeframe and with reasonable investments of time, energy, and money.

Resources, Staffing, and Budget

Three of the biggest challenges ahead for small-to-medium sized news publishers who are interested in setting up a paid subscriber acquisition effort are:

- The budget to invest;

- Availability of staff time and skill sets;

- And curated resources to assist with campaign planning.

Of the seven publishers in this research, less than half had invested in paid acquisition efforts over the last two years. And, combining the efforts of all of those that had invested, the total dollar amount invested was still very small. This highlights the first problem: many early-stage publishers simply don’t have the budget to invest in growth, which is a Catch-22.

More established publishers, with larger teams, struggled less with available budget and more with freeing up staff time. My observation is that publishers with six or more staff people or freelancers start to experience increased complexity in the work environment, leading to less nimbleness. In my experience this is usually due to the requirement of more clearly defined roles and management structures that are needed as team and audience size increases. This is another difficulty for those seeking to grow a digital news startup, where constant innovation is a likely part of the recipe for financial sustainability. (As Matt Thompson and Emily Goligoski wrote for this project, “membership cannot scale beyond an organization’s ability to serve its members. In some cases organizations are strategically limiting their growth to support members and ensure member value is not diluted. We think this has important ramifications for restoring the ‘human element’ to news.”)

The third big challenge lies in having knowledge or access to knowledge about where to start when trying to build effective paid subscriber acquisition campaigns. Most publishers in the study are actively engaged in using paid marketing to promote their content on platforms, but none had active paid acquisition campaigns underway when the research started.

This challenge was clear in a recent informal survey of 20 newsrooms, and the question “what do you believe to be the main challenges for your organization in committing resources to paid acquisition campaigns?” to which 70% of respondents answered “resources to assist with campaign planning.”

This isn’t entirely surprising given how quickly the landscape of lead generation advertising options shifts and how frequently the algorithms behind these systems change. It can be a full-time job staying on top of all of these shifts and changes: changes that can significantly impact campaign performance. That is perhaps the largest challenge here. Only the largest publishers have a dedicated resource focused on this; most others make do with this expertise being just a part of larger job description.

A related research question that we’ve surfaced is: how can early-stage, small, and mid-sized digital-first news publishers take advantage of the opportunities that paid acquisition presents?

So far we have clear patterns emerging in both the data that is being collected directly from participating publishers and from less formal data we’re gathering via literature reviews, interviews, and surveys.

Paid lead acquisition is an established path to new customers that is being leveraged by many growth-oriented businesses. It’s not just tech startups, online mattress firms, and companies that sell online courses; it’s being used by many small-to-medium sized businesses across the country, including everything from car dealerships, to plumbers, to real estate agents and more.

There are signs that larger, more digitally-savvy newsrooms are increasingly investing in paid growth of their email newsletter lists. Case studies are surfacing that report promising results toward converting free newsletter readers into paying supporters, like WhereByUs and the Seattle Times. And the data we’ve collected in this research so far indicates that new leads can be acquired for a low enough cost to provide a positive return on that investment over time.

I believe the question “can publishers who seek to grow their membership invest in paid lead acquisition tactics and predict with strong confidence the rate of return on their investment?” can be answered with “most likely; more data forthcoming.” It is clear that the tactics of paid lead acquisition do translate to the world of journalism — people do respond positively to the advertising campaigns, subscribe from social platforms, and stay engaged. And these strategies can be useful even if you have a paywall or patronage model.

To fully take advantage of these opportunities, I think the sector needs to further develop the following:

- An easy-to-use spreadsheet template, or calculator, that does that math for publishers who are trying to justify the investment (to themselves, to investors, and/or to funders). It should quickly provide a detailed prediction for a range of possible outcomes based on a small number of inputs. And it should make the investment case clear, as well as defining the metrics that publishers will need to keep an eye on.

- A playbook for how to get started with paid acquisition in the context of journalism and local news. This should be a resource that is frequently updated to stay current with the field, and it should aim to surface the best bets in the moment for publishers who are just getting started. Ideally, it would also provide detailed case studies from publishers who’ve led the way.

- Most importantly, funding to help publishers get underway with this work, knowing that audience growth has the potential for exponential returns across several indicators. And for publishers who’ve already established their paid acquisition strategy, there’s a need for funding to scale their campaigns. The would ideally be in the form of “no strings attached” operational money, where a funder might say, “Show us you’ve got an acquisition model that works — money in equals more money out — and we’ll give you a grant to scale it.”

The simple act of getting started with these campaigns helps to deepen the publisher’s understanding of how it works. We’re seeing it boost their confidence in being able to continue the work independently. In the words of one of the publishers in the study, “It has been incredibly successful in terms of getting us new subscribers [and] a lot of insight on how to run a successful campaign. We’ll be interested to see the quality of these subscribers going forward, but it definitely proves that investment in lead acquisition can pay off if done correctly.”

You can follow along at @membershippzzle, @trypico, or @phillipadsmith. And if you have questions, comments, or input that could help to guide it forward, please get in touch. Specifically, if you’re in a newsroom that’s leveraging paid acquisition and you’re open to sharing your wisdom, I’d like to hear from you. You can find me on the web as @phillipadsmith and at phillipadsmith.com.

This story originally appeared on the website of The Membership Puzzle Project, a public research project into membership models by the Dutch journalism platform De Correspondent and New York University’s Studio 20 Program.

Phillip Smith is a veteran digital publishing consultant, online advocacy specialist, and strategic convener. He is the founder of the Journalism Entrepreneurship Boot Camp. If you enjoyed reading this, you can find him on Twitter.

Phillip Smith is a veteran digital publishing consultant, online advocacy specialist, and strategic convener. He is the founder of the Journalism Entrepreneurship Boot Camp. If you enjoyed reading this, you can find him on Twitter.

Note: Jason Bade, Jessica Best, Burt Herman, Emily Goligoski, Ariel Zirulnick, and Margaux Savey contributed to this post.