Indonesia | বাংলা | Español | Русский

GIJN’s latest webinar focused on strategies for financial survival for investigative media. Photo: Pixabay

Since the beginning of the coronavirus pandemic, media colleagues have focused their efforts on covering the story, exposing disinformation, and tracking and making sense of the data. Most media have concentrated on the immediate needs of their public and staff.

But colleagues are also quickly realizing that the risk to long-term viability for their organizations grows daily. Media Development Investment Fund CEO Harlan Mandel has laid out three strategies to address this looming viability crisis: hoard cash, focus on the content, and take care of your team. If you have not read his letter to media, you should.

The question that media, especially smaller outlets, have is what specific actions do they need to take to achieve these goals. What to spend and what to save? When to make the difficult decisions? These were among the difficult questions discussed at GIJN’s latest webinar on strategies for financial survival, in which I was joined by veteran fundraising consultant Bridget Gallagher and Alan Soon of media start-up center Splice Media.

The answers to these questions are unique to individual markets and media. So, here I want to walk through a simple cash flow structure and raise some considerations that should highlight necessary decisions.

Mission & Culture

Like any business planning effort, media should start with mission and culture. Nonprofit media especially need to have a common vision with their boards and team about how to manage in this crisis. How will the organization support staff, communicate with board members and grantors, manage vendors and customers? How will they prioritize decisions for the long-term viability of the institution versus the safety and long-term productivity of the individuals on the team? Sometimes it may be more effective to fold a program or an organization and align resources with larger institutions in order to deliver on the original reporting mission.

Cash Flow Management

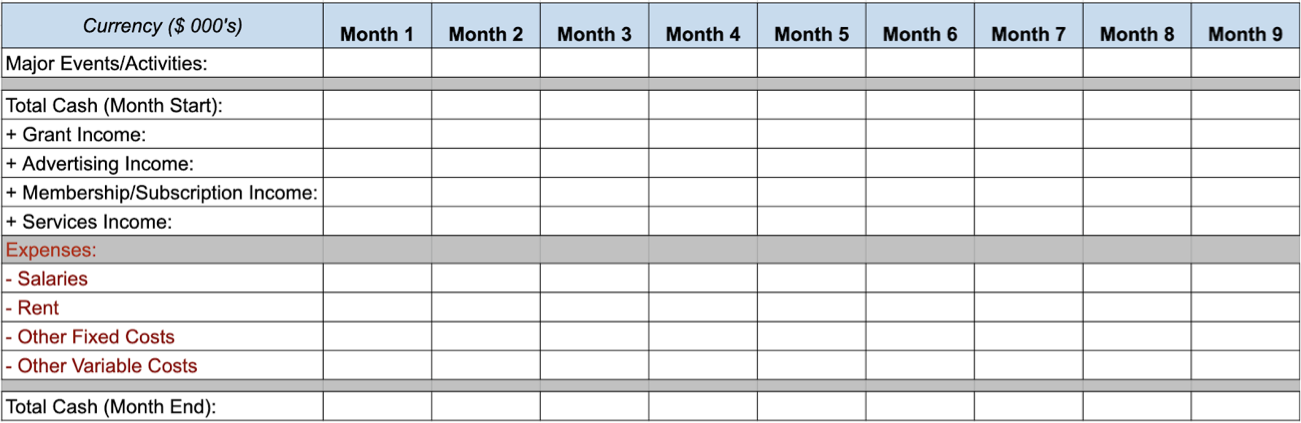

Most media are familiar with income statements and balance sheets. But in this situation, it is the cash flow statement that will provide the most help in identifying planning decisions that need to be made to continue the organization’s mission. To develop the planning considerations, we are going to work through a simple monthly cash flow statement. The cash flow statement starts with the total amount of cash available, adds in new cash revenue from monthly operations, and then subtracts cash expenses to get cash at the end of the month. For most nonprofit media, grant revenue creates a bank of cash that is gradually spent over the life of the grant. Cash income from commercial operations adds to the cash available. The goal of the planning considerations below is to think through how each of these lines will change monthly during the pandemic and what decisions are needed to extend the period before cash is depleted.

Simplified Monthly Cash Flow Statement

1. Existing Cash

Especially for media companies that rely on grants, this amount is mostly the unspent amount of grant cash. Grants divide into two types – operating grants and project specific grants, usually earmarked for specific project uses. For cash flow planning purposes, you should be clear whether project grant cash can be redeployed. Are there any restrictions? Many donors have already waived these restrictions. But it’s best to be clear. If there are restrictions, note the amount of restricted cash and the expenses associated. Set it aside.

2. Grant Income

Have you contacted your major donors to discuss your current situation and to get feedback on their outlook on media support during the coronavirus pandemic? For unrestricted grants, you want to understand changes in the commitment, as well as any emergency funds that may be available. If your operating grants are funded at particular dates in the calendar, you want to confirm these dates. If these payments are contingent on “reports and monitoring,” you want to clarify any new (ideally simpler) reporting requirements. You don’t want funding delays because of reporting requirements.

3. Advertising

Advertising income includes both advertising revenue from ads sold directly and income from advertising networks, like Google AdSense. These will each have different planning considerations.

Sold Advertising: For ads sold in-house, most advertisers and agencies pay at 90 days. So, you will have outstanding accounts receivable for ads that have already run, but payment has not yet been received. Be prepared that local advertisers will also be conserving cash, so they will try to extend or delay payment. This may impact the agencies that created or booked the ads, which will in turn impact your payment.

With advertising demand collapsing globally, the best use of ad sales teams is chasing down invoices and payment. Some techniques include:

- Early payment discounts: Give the advertiser/agency an incentive to pay in advance.

- Waive fees: Offer to waive fees for ad creation or other services for payment on time.

- Joint approaches: Often agencies are hostage to their advertiser clients. Sales teams can work with agencies to approach advertisers together. Most advertisers make the decision to slow payments with little regard to the impact on agencies or media. Make the impact they are having clear.

Network Advertising: Most media, especially small media, start with network ads from Google Ads, YouTube advertising, and Facebook Audience Network. These advertising platforms typically pay at 30 days after the ad runs. At that point, earned advertising is shown in the ad dashboard as finalized revenue. This revenue accrues until the account reaches a self-defined threshold and then the advertising network pays a registered bank account.

- Get the Cash: Many small media use these advertising dashboards as a “savings bank” to accrue cash. If you are doing that, now is the time to get the cash in your bank account.

- Workarounds: Some media using ad networks in “non-network markets” have created workarounds — “tricks” to use the ad network and then book the revenue to an account registered in a network market. Again, do what you can to get the cash into your home country bank account.

Other Advertising: For all of these efforts, media organizations will need to balance time required to execute, the potential cash expected, and commitments to sales staff. Chasing advertising invoices is time consuming and frequently demoralizing. Prioritize the outstanding invoices based on amount, advertiser or agency importance, and ability to collect. You will need to balance sales staff time between the expected receipts and the amount of time and expense needed to chase the accounts.

The ultimate consideration for small independent media outlets is their commitment to the advertising sales staff. Most analysts are seeing steep declines in advertising as audiences are told to shelter at home. Consumption drops, advertising dries up, but sales staff expenses will remain. At what point and how will your media organization manage this mismatch between expenses and revenue?

4. Membership/Subscription Income

During this crisis, many media with subscription programs have dropped their paywalls in whole or in part to provide free access for either all stories or just stories related to the coronavirus outbreak.

Most membership programs have strongly re-engaged their members to maintain and potentially increase support for their coverage. During the early days of the pandemic, many media are experiencing increases in membership revenue. Audiences want to be supportive and demands for giving have yet to crowd out the media’s membership message. But, be prepared that as donation demands from other charities and small businesses start to grow, the demand on the public’s charity will also grow and this may result in a decline in membership engagement and revenue.

Membership: The coronavirus crisis may drive increases in member registrations and membership payments. If you operate a tiered membership scheme with free registration and a higher paid membership level, now is the time to test communications to convert registered users to members. During the crisis, the most important effort will be communications. Developing a regular, clear, and engaged communications plan will help you maintain and grow current members, convert unpaid registered users, and to increase overall revenue.

Subscription: Striking a balance between maintaining your media’s subscription paywall and dropping the paywall to provide greater access to your reporting involves a lot of detailed decisions depending on local rules and your own terms of service. Usually when a paywall is dropped, existing subscribers are entitled to have their subscription period extended by the same length of time as the content is offered for free. Some options to consider are:

- Free Access to Coronavirus Coverage: This should keep the period for existing subscribers the same, so renewals and new cash remains on schedule.

- Move Subscribers to Members: When the paywall comes down, you will want to communicate with your subscribers about the change in access and ask them to donate their subscriptions during the crisis coverage. This allows your media organization to keep everyone on a renewal schedule with cash renewing as expected.

5. Services Income

Income from services like training, editorial research, and data analysis are financially similar to advertising sales. Most small media provide services with payments either after the service is delivered, like advertising, or with some deposit to initiate the service or in the case of training, to hold the space.

For services that are paid after the service is delivered, many of the advertising considerations above, especially those on collections, will hold for other services as well. For services paid upfront or for deposits against services, if the service can still be provided then the issue is again on final collections. If the service is no longer critical to your organization’s mission, then refunding the cash quickly will help the purchaser who will almost certainly be experiencing their own cash flow issues.

6. Expenses

For most nonprofit media companies, the main expenses are salaries and freelance commissions. Most other expenses are small and can be postponed until later dates. Variable expenses — like web hosting costs or reporting travel expenses — will need to be managed carefully to preserve cash without undermining your reporting mission. For example, some media with large reporting areas have temporarily eliminated reimbursements for reporting travel expenses, primarily to keep staff working from home.

Much of the decision-making on expenses will require the company to prioritize which expenses to pay, at what level, and when. Some services like web hosting and staff salaries are critical to operations, but some like office supplies can be delayed. You may even prioritize what kind of vendors you pay first. Some clients are paying small businesses with immediate cash needs ahead of major corporations like phone and electric utilities. Prioritizing expenses allows for decision-making on an expense-by-expense basis. Be aware that you may have some major expenses that are paid automatically through credit cards or bank transfers. If the expense is significant you will want to consider moving it back to manual payment. This will allow you the option to pay late, pay partially, or to delay.

Salaries and Freelance Commissions: As cash and resources get tighter, your media organization will need to make decisions about staff salaries and freelancer commissions. Nonprofit media companies with large cash amounts at the outset of the crisis may not feel any pressure in the short-term. For profit media companies with a heavy reliance on advertising income are already feeling this pressure. Newspapers in the United States and Australia are furloughing workers (putting them on unpaid leaves), executive pay cuts have been announced at BuzzFeed, and in at least two cases in Australia small community newspapers have announced the end of operations.

Many small nonprofit media outlets rely heavily on freelance contributors and trainers. These independent workers are especially vulnerable to personal cash flow issues. You should be making plans for how to compensate as quickly as possible after content or training has been provided. How you manage the mix of staff versus freelance contributors will also present a long-term problem as cash shortages become more acute as the pandemic drags on. How you manage your cash and support your team — both staff and freelance workers — will in the long-term determine whether your media organization remains viable.

The situation is bleak and the coronavirus pandemic has really only impacted a few dozen countries and regions. Experts expect the crisis to last for many months. Looking critically at your resources — cash and people — and determining how you manage them to stay on mission will determine the long-term viability of your organization. The cash flow statements can help you determine where there is an issue — and when there is one coming. As a rule in this environment: When in doubt, save early, spend late.

For more on sustainability during COVID-19:

COVID-19 Grants for Journalists and Media Worldwide

How to Minimize the Impact of COVID-19 on Your Media Business

GIJN resources on sustainability

Ross Settles is an adjunct professor focused on media innovation and entrepreneurship at the Journalism and Media Studies Centre of Hong Kong University. He has almost three decades of experience working in strategy, marketing, and product development for media companies in the US, East Asia, and Latin America.

Ross Settles is an adjunct professor focused on media innovation and entrepreneurship at the Journalism and Media Studies Centre of Hong Kong University. He has almost three decades of experience working in strategy, marketing, and product development for media companies in the US, East Asia, and Latin America.