Many media investors see disaster everywhere they look, as traditional media lose audience, revenues, and relevance.

Sasa Vucinic, co-founder and co-managing director of North Base Media, sees great investment opportunities, especially in developing markets such as Central Europe, Asia-Pacific, and Latin America.

Sasa Vucinic, co-founder and co-managing director of North Base Media, sees great investment opportunities, especially in developing markets such as Central Europe, Asia-Pacific, and Latin America.

“We invest in serious digital-only media oriented toward the younger audience that can disrupt their markets. And we think it’s a phenomenal business that will bring great financial returns.”

Vucinic, who began his journalism career in Serbia, has been a crusader for media organizations that tell the truth about corrupt, oppressive regimes. I reached him via Skype in South Korea, where he was looking at investment opportunities. I wanted to ask him about social purpose investing, where investors direct their money toward organizations that not only give a financial return but also have a positive impact on society.

Vucinic said he no longer talks about social impact with investors. “I spent 16 years trying to prove to investors that a media company has a two pronged nature: It is a business that will be sustainable and profitable, if possible, and at the same time it provides an incredibly important role in the society,” he told me. “I actually think that if you do not understand that media plays an important role in society, you’re not very likely to invest in it anyway.”

A Bank for Media

Vucinic has worked both sides of media investment: As the editor-in-chief of a news magazine and radio station in Belgrade, he found it difficult to get the financial support he needed.

So he decided to see if he could change the financial equation. In 1995, he co-founded the Media Development Investment Fund (MDIF) to act as a kind of investment bank in support of media that aimed to report aggressively on oppressive regimes.

The organization mostly made loans, at first, rather than taking an equity share, because that was less threatening to the fiercely independent journalists they were financing. The journalists were wary of sharing ownership with any investors. In 20 years, the organization has provided $153 million in financing and professional consulting to more than 100 businesses in 39 countries.

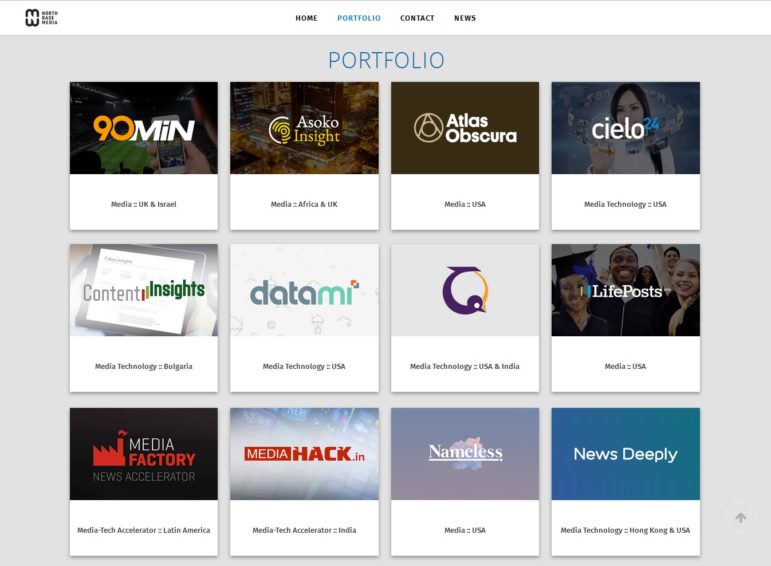

North Base Media’s investment portfolio.

However, the investment world has changed, Vucinic says, and now independent media companies are willing to give a share of equity to their investors. The change has been driven in part by what Vucinic calls an explosion of new technology and new ways of delivering journalism.

In 2013, he co-founded North Base Media to take advantage of the new environment. Typical of their investments is The News Lens in Taiwan (“News worth knowing, voices worth sharing”). Its founders were young journalists who found nothing interesting and relevant in the sensationalist, gossipy news products of the country’s huge media conglomerates.

And even though the island of Taiwan is relatively small (population 23 million), North Base Media saw the possibility of capturing the under-30 audience with serious journalism in a different format.

And even though the island of Taiwan is relatively small (population 23 million), North Base Media saw the possibility of capturing the under-30 audience with serious journalism in a different format.

Opportunities Everywhere

“There are information-starved populations everywhere in the world,” Vucinic said. “In every country you could come up with 20, 30, 50 smaller media companies that are feeding one specific need — it could be foreign policy, theater . . . ”

What these startups need most besides money, Vucinic said, is training on the business side — sales, marketing, financial management, administration. “Nobody launched a startup knowing what cash flow is. But if they don’t understand it, they could bankrupt the company.” In the Media Factory News Accelerator in Argentina, I did training in those areas with three companies that North Base was financing.

What these startups need most besides money, Vucinic said, is training on the business side — sales, marketing, financial management, administration. “Nobody launched a startup knowing what cash flow is. But if they don’t understand it, they could bankrupt the company.” In the Media Factory News Accelerator in Argentina, I did training in those areas with three companies that North Base was financing.

When I mentioned to Vucinic that the independent digital news organizations represent a tiny percentage of all media revenue, he suggested that subsidies are needed. The European Union, for example, recognized the strategic importance of agriculture and developed many programs to support it — low interest loans, price supports, crop insurance. It could do something similar for journalism, recognizing its strategic importance to strong democracies.

Stacked Financing

He also proposed a kind of stacked financing structure that could accelerate investment in independent media. A $50 million investment fund might consist of a bottom layer of $10 million from a government organization — the World Bank, USAID, Inter-American Development Bank, etc. — whose equity stake would be the last to be paid out.

The second layer of $10 million would be banks seeking more than the 1% or 2% return on government bonds or other investments. Their return could be capped at 4% or 5%.

Then the final piece of $30 million would come from risk-tolerant venture-capital investors. “They are fast, nimble and would invest in smaller amounts,” Vucinic said. “Once you give them a return of 10% or 15%, they will come back and do it over and over again.”

Media companies need more support from democratic societies than they are getting, Vucinic added.

The importance of media is “absolutely obvious. The first thing any reasonably intelligent dictator does is kill independent media. There’s a reason for that. Either you have a free press and a reasonably decent country, or there is a dictator and no free press.”

“We all know what needs to be done,” Vucinic said. For him, the changes can’t come fast enough.

This post originally appeared on the blog News Entrepreneurs. It is re-published with the author’s permission. A Spanish version of this post is available here.

James Breiner is a consultant and visiting professor at Spain’s University of Navarra. He is former director of the Global Business Journalism program at China’s Tsinghua University and founding director of the University of Guadalajara’s Center for Digital Journalism. He has worked as publisher, editor, and I-team leader.

James Breiner is a consultant and visiting professor at Spain’s University of Navarra. He is former director of the Global Business Journalism program at China’s Tsinghua University and founding director of the University of Guadalajara’s Center for Digital Journalism. He has worked as publisher, editor, and I-team leader.