Editor’s Note: The proliferation of nonprofit newsrooms is one of the more promising developments in an industry wracked by a crumbling financial base and sweeping technological change. Since 2000, dozens of nonprofit media groups have sprouted, not only across America but worldwide. They range from multimillion dollar ProPublica to community-based startups like San Diego’s inewsource. Many are deeply committed to investigative and accountability journalism, working to fill a void left by a mainstream media that either can’t or won’t do its job as social watchdogs.

Editor’s Note: The proliferation of nonprofit newsrooms is one of the more promising developments in an industry wracked by a crumbling financial base and sweeping technological change. Since 2000, dozens of nonprofit media groups have sprouted, not only across America but worldwide. They range from multimillion dollar ProPublica to community-based startups like San Diego’s inewsource. Many are deeply committed to investigative and accountability journalism, working to fill a void left by a mainstream media that either can’t or won’t do its job as social watchdogs.

In April, the John S. and James L. Knight Foundation published the third installment in a series of reports since 2011 tracking the progress of nonprofit news sites as they strive for a sustainable financial base. In some ways this is the most important of its three reports, as researchers can now analyze progress over several years by various groups. The study offers needed ideas about diversifying a nonprofit newsroom’s revenue, the importance of having a business plan, building capacity, and measuring impact.

There are many lessons for GIJN’s 114 member organizations spread across 53 countries — all of whom are media nonprofits or NGOs. But there are some important caveats. The Knight reports focus entirely on US-based nonprofits. Many GIJN members exist in countries with relatively small and undeveloped advertising markets. In too many nations, overbearing governments control vast shares of the ad dollars and pressure private companies to advertise with political allies. Independent journalists face heavy-handed censorship, criminal libel laws, and physical attacks. Few countries, too, have America’s strong tradition of philanthropic support of nonprofits, with its 100% tax deduction for donations. Nor are mainstream media in many places accustomed to working with outside newsrooms – a practice that major U.S. outlets have only recently become comfortable with.

The excerpts below focus largely on increasing revenue diversification and online traffic. For the full report, see Gaining Ground: How Nonprofit News Ventures Seek Sustainability.

This marks the third installment in a series of reports produced by Knight Foundation since 2011 tracking the progress of nonprofit news sites as they strive for sustainability. The first report, “Getting Local: How Nonprofit News Ventures Seek Sustainability,” produced in 2011, focused on eight nonprofit news organizations: The Bay Citizen, Chi-Town Daily News, Crosscut, MinnPost, New Haven Independent, St. Louis Beacon, The Texas Tribune and the Voice of San Diego. Today, some of these sites are thriving, some have merged with others and some have closed their doors. When we began studying the field of nonprofit news organizations, sustainability of operations was unquestionably the leading concern for the field.

This marks the third installment in a series of reports produced by Knight Foundation since 2011 tracking the progress of nonprofit news sites as they strive for sustainability. The first report, “Getting Local: How Nonprofit News Ventures Seek Sustainability,” produced in 2011, focused on eight nonprofit news organizations: The Bay Citizen, Chi-Town Daily News, Crosscut, MinnPost, New Haven Independent, St. Louis Beacon, The Texas Tribune and the Voice of San Diego. Today, some of these sites are thriving, some have merged with others and some have closed their doors. When we began studying the field of nonprofit news organizations, sustainability of operations was unquestionably the leading concern for the field.

In 2013, Knight released “Finding a Foothold: How Nonprofit News Ventures Seek Sustainability,” which examined a larger cohort of 18 nonprofit news organizations. The report found much more stability among the organizations, as many had secured a footing in generating revenue and building audience.

This report builds on the prior analyses by continuing to benchmark revenue, expenses and audience metrics and to identify emerging best practices. The report analyzes trends among 20 local, state and regional nonprofit news organizations. It also incorporates insights from interviews with leaders of a few additional nonprofit news organizations that have a predominantly national scope. Many, though not all, of the organizations included in the study have been funded by Knight Foundation.

Developing Business Strategies

Nonprofit news sites that report having specific financial goals increased revenue at a far higher rate than those without financial goals. Revenue growth was also higher among the organizations that had a business or strategic plan.

The specificity and time frame of financial goals reported by sites varied, but as a whole this type of mindful planning was associated with sites exhibiting the most growth.

WyoFile is an example of a smaller organization that has been very intentional in its business planning, using a three-pronged approach: a five-year strategic plan dictates overarching goals for the organization, annual budgetary goals and a corresponding development plan. In this way, WyoFile maintains its focus on its longer-term goals while creating tactics to achieve those goals and metrics to measure progress toward them. Specific metrics in the development plan for 2014 included 100 percent donor retention from 2013, re-engaging 50 percent of lapsed donors from 2012, recruiting 75 new donors and securing $300,000 from six foundations. The strategic plan has helped WyoFile hone its focus on the most promising revenue streams. It also has led to revelations about how to increase those revenue streams (for example, adding expertise in underwriting and using a contract or commission-based compensation structure for this role).

Revenue Composition

The nonprofit news organizations examined are still highly dependent on foundation and grant funding, which represented 58 percent of total revenue in 2013. Since 2011, foundation funding as a percentage of total revenue has decreased by 5 percentage points but even so, over half of sites get the majority of their revenue through foundation funding and 2 in 5 rely on foundations to supply 75 percent or more of their total revenue.

Earned income as defined as revenue from advertising, events, sponsorships, training and subscriptions constituted nearly a quarter of total revenue (23 percent) for the average site in 2013, up 5 percentage points since 2011. Though the increase is moderate, many sites are trending toward greater sustainability.

Earned income accounted for 40 percent or more of the total revenue generated by five sites in 2013: The Rapidian (75 percent), New England Center for Investigative Reporting (50 percent), New Haven Independent (46 percent), VT Digger (42 percent) and MinnPost (40 percent). However, about a third of the nonprofit news organizations generate less than 10 percent of total revenue through earned income.

Foundation & Grant Funding

Total foundation finding averaged $424,030 in 2013 and median for the cohort was $268,272. Many sites acknowledged the difficulties in retaining funding support from national foundations over a long period of time; in fact foundation and grant support shrunk in 2013 relative to 2012 for 50 percent of the sites in this study. News sites noted that the ability to raise money to cover general operating funds becomes more difficult as they mature, and they sense that founda^tions do not want to become a line item in the budget that is expected to return year after year.

Only a handful of organizations demonstrated little dependence on grant funding as a share of their overall revenue. The Rapidian received no foundation funding in 2013. At Charlottesville Tomorrow and MinnPost, foundation funding accounted for about 15 percent of their overall revenue.

Donations and Membership Dues

Individual donations and membership dues was the fastest-growing source of revenue for several organizations. Two-thirds of sites increased donations in 2013 and median revenue from donations nearly doubled from $33,000 in 2012 to $60,000 in 2013.

State and regional organizations earned more on average through donations than local sites but local organizations have seen the biggest gains in the average number of donors per year. Local sites reported a median donation of $104,000 in 2013 and state and regional sites earned $29,836. During the same period, seven of the 10 local sites received more than $70,000; by comparison only 4 in 10 state and regional sites eclipsed $70,000 with The Texas Tribune and MinnPost being the biggest earners of donation revenue, generating $1,485,354 and $709,745.

Organizations demonstrating strong donation revenue in 2013 and growth since 2011 include The Lens ($135,000 in donations, 634 percent growth), City Limits ($20,000, 721 percent), Voice of San Diego ($741,000, 27 percent) and VT Digger ($106,000, 133 percent).

For all sites, the average number of donors has increased from 498 in 2011 to 757 in 2013. This increase is mainly driven by donations of less than $1,000, which accounted for 97 percent of all donations in 2013.

Nonprofit news organizations have increasingly focused on building their donor base and donor repeat giving, which they view as a more predictable funding source over time than foundation grants.

Though many sites do not differentiate between “donors” and “members” since both are individual supporters, several sites have sought to create a distinction and promote the value of becoming a member. Exclusive access to content and events are among the benefits that sites have conferred to members.

MinnPost has piloted an innovative approach to monetizing membership by crowdfunding beats related to the environment and mental health/addiction. Donors for these beats commit to three years of funding ranging from $1,000 to $5,000 per year and receive recognition of their contribution on the MinnPost website. MinnPost raised $709,745 through 2,094 donors in 2013, a 6 percent increase since 2011. With support from Knight’s Local Media Initiative, the organization is experimenting with attracting small donors to support its reporting by encouraging larger donors to offer matching funds.

Earned Income

Of the 20 news organizations included in this study, all but three reported at least one source of earned income among the following categories in 2013:

In-person events: Corporations or institutions that pay to be associated with events hosted by the nonprofit news organization

Advertising: Corporations or institutions that purchase banner or display ads on the nonprofit news site

Sponsorship: Corporations or institutions that pay to associate their brand with the content of the nonprofit news organization

Syndication: Content sold to other organizations for republication

Training: Training courses sold on investigative reporting techniques

Subscribers: Individual subscriptions sold to specialty publications

Among the six areas of earned revenue reported in this study, sponsorship, advertising and syndication were the most common forms of earned income. Half or more of the organizations reported revenue from each of these sources.

Sponsorships

Corporate sponsorships made up the largest share of total earned revenue, and many sites had success in increasing sponsorship revenue. Ten sites earned revenue from corporate sponsorships in 2013, raising an average of $286,843, 60 percent higher than 2011.

Most news sites received sponsorship dollars to support either events or specific content. Several sites helped drive growth in sponsorship revenue by hiring new staff focused on building corporate sponsors and developing new services that lent themselves to sponsorship opportunities.

Events

Events were among the sources of revenue that had gains, with median growth reported at 27 percent since 2011. Events were also one of the few revenue sources that sites have experimented with in recent years, with six organizations adding events to their programing since 2011.

Some sites use events as a key component of their revenue strategies, while others treat events primarily as a vehicle for engaging with their readership and members of the community. Overall, news organizations in the study staged a total of 228 events attended by more than 30,000 people with the average site earning $49,604 in event based revenue in 2013.

NJ Spotlight has attracted sponsors to support a webinar series launched in 2013 to inform its readers about public policy and other current topics. The organization maintains a list of webinar topics to bring to prospective sponsors, and interest from sponsors drives which topics it selects to pursue. For example, AARP sponsored a webinar that covered a study of long-term care in New Jersey and the use of big data in health care. After starting with two webinars in 2013, NJ Spotlight now hosts monthly webinars, with recent participation as high as 200. Webinars have helped the site increase its sponsorship revenue by 50 percent in 2013 to $141,000.

Advertising

While advertising is the most common source of earned revenue, median growth of advertising revenue was only 2 percent from 2011 to 2013. Several organizations and thought leaders interviewed believe traditional advertising will be a declining revenue source for the nonprofit news industry as sites struggle to compete with the volume of traffic offered to advertisers by larger, for-profit news organizations.

Native Advertising

With circulation numbers that could not compete with the for-profit city paper, the Voice of San Diego concluded that traditional advertising was not the right fit for the site. However, the leadership felt confident that the site could win on influence and engagement, since it has a reputation for appealing to an audience that is highly engaged and motivated to improve the city of San Diego. Voice of San Diego capitalized on this by launching Partner Voices, a new section dedicated to telling the stories of nonprofits. The site’s version of native ads or advertorials, these messages on local nonprofits are written by freelancers and paid for either by the nonprofits or by corporate sponsors on their behalf. Partner Voices is housed in its own section of the website so that there’s a clear line between it and Voice of San Diego’s core editorial content.

The Voice of San Diego ended 2014 with $127,000 in revenue from community partners, the majority of which comes from the Partner Voices program. Nonprofits that sign up for a full year pay $10,000 for one promo per month, or they can pay $1,000 to $1,500 for individual promos. Corporate sponsors pay slightly more, since they get a short write-up on the site as well as the nonprofit they sponsor. In addition to the promos on the site, nonprofits buying into Partner Voices receive other benefits, including access to quarterly workshops for nonprofits to share best practices on everything from fundraising to marketing and social media strategies. In essence, through Partner Voices, the Voice of San Diego has built an entire network of supporters.

Web Traffic

Most sites have developed social media strategies for engaging with their readers on various platforms. The strategies generally involve regularly posting content—both sites’ own content and partner content—to Facebook and Twitter in order to remain visible. For some of the larger sites, the strategy hinges on the ability to devote full-time staffers to social media efforts, though some of the smaller, local sites have been successful in driving social media traffic by enlisting the entire reporting staff in these efforts. Facebook and Twitter are used universally by the organizations and a few have begun experimenting with other platforms, including Tumblr, YouTube and Instagram.

Across the board, sites experienced strong growth in mobile traffic. On average, 22 percent of their traffic came from mobile devices in 2013, up from 14 percent in 2012. Nearly all sites are moving to a responsive design that optimizes content viewing on mobile phones.

Driving Web Traffic

A handful of sites are thinking more creatively and using new platforms and social media-based strategies to attract and retain readers. These sites have prioritized making their content mobile-friendly and cross-linking all their content with social media accounts.

The Center for Investigative Reporting nearly quintupled its unique visitors from 243,000 in 2012 to 1.2 million in 2013 by partnering with prominent news organizations on large-scale investigations and placing an increased focus on driving traffic to its website. Additional increases in traffic have come through the site’s launch of I-Files, an investigative news channel on YouTube that averages more than 3 million views annually. The I-Files channel features the best investigative news videos from around the world; in addition to the center’s work, it carries content from The New York Times, PBS’s “Frontline” and other news organizations.

Voice of OC has increased unique page views steadily (up to 348,000 in 2013 from 284,000 in 2012 and 165,000 in 2011) through its shrewd social media strategy. The site posts its top stories to Facebook every day and tags each story by target audience, geographic location and interest to encourage greater engagement with content. Furthermore, it tracks stories’ reach using bitly links to monitor performance and make adjustments throughout the day. Its emphasis on posting stories to Facebook has partly fueled the rise of its Web traffic coming from mobile to 27 percent in 2013, and as of mid-2014 mobile approached 40 percent of all traffic.

Measuring Reach & Impact

Most nonprofit news sites track basic Web analytics metrics (such as visitors, followers and page views) to understand their reach, and use proxies such as blog comments and event attendance to get a sense of audience engagement. But most organizations struggle to more methodically capture data about the impact of their reporting. A few organizations are beginning to push beyond standard Web metrics and experiment with new forms of impact measurement.

Most nonprofit news sites track basic Web analytics metrics (such as visitors, followers and page views) to understand their reach, and use proxies such as blog comments and event attendance to get a sense of audience engagement. But most organizations struggle to more methodically capture data about the impact of their reporting. A few organizations are beginning to push beyond standard Web metrics and experiment with new forms of impact measurement.

Chalkbeat defines impact as when its reporting influences the debate on educational issues and on decisions made in the education field. It has developed an impact tracking system called MORI (Measures of Our Reporting’s Influence), which it uses to help plan content around the type of impact it seeks and to measure the impact of content. A WordPress plug-in, MORI enables reporters to enter story characteristics such as story type, audience and theme, as well as evidence of impact, including actions that were informed by the story, civic deliberations spurred by the story and pickups of the story. The program aggregates this information into reports that can be used to track Chalkbeat’s progress toward its annual editorial and engagement goals.

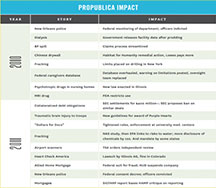

ProPublica employs a Tracking Report, an internal document that is updated daily and shared with management and the board of directors monthly. The report records each story published as well as official actions (such as announcements of policy reviews or statements by public officials), opportunities for change (hearings, studies or commission appointments to study an issue), and actual change that can be causally connected to ProPublica’s work. ProPublica maintains the Tracking Report for months and sometimes years beyond the publication of a story, acknowledging that the types of change ProPublica seeks to create through reporting may take a long time to come about.

ProPublica employs a Tracking Report, an internal document that is updated daily and shared with management and the board of directors monthly. The report records each story published as well as official actions (such as announcements of policy reviews or statements by public officials), opportunities for change (hearings, studies or commission appointments to study an issue), and actual change that can be causally connected to ProPublica’s work. ProPublica maintains the Tracking Report for months and sometimes years beyond the publication of a story, acknowledging that the types of change ProPublica seeks to create through reporting may take a long time to come about.

WisconsinWatch has developed a detailed system of tracking the distribution of its stories. The site has set up Google Alerts using reporter names, story names and more, and also searches on the sites of the top news organizations that pick up their stories. Information gathered from these searches—type of story, story elements published, names and geographic locations of distributing publications, readership of distributing publications, and more—is recorded and visualized using mapping software including BatchGeo and Tableau.

The Center for Investigative Reporting is the first media organization with a full-time Ph.D. in social sciences devoted to cataloging, measuring and analyzing media impact. The analyst has developed a system for cataloging offline impact–real-world change—that results from journalism. Using an impact taxonomy developed with input from a wide range of media organizations, the analyst has created a system for converting anecdotal evidence (i.e., media pickup, editorials referencing the work, mentions by public officials, new laws and direct response from audience, among others) into qualitative data sets that can be analyzed to better understand what impact is and how it happens. To create the data set, reporters and editors complete a Web form for each instance of real-world change associated with their work. This information flows into a database that can be easily sorted and filtered; the analyst can then identify patterns and questions for deeper inquiry. The center has consulted with a number of media organizations to help them set impact goals, develop strategies, and construct plans for measurement and analysis. During these coaching engagements, organizations conveyed their interest in using a tracking system such as the one the center uses(currently built using Podio, a workflow collaboration platform). In response to this demand, the Center for Investigative Reporting is developing a proprietary tool that other organizations will be able to use.

Conclusion

The digital age has drastically and forever altered the landscape of local news. Faced with traditional media organizations that continue to reduce their resources committed to local news coverage, it’s imperative to support approaches to safeguarding the supply and quality of local information and reporting.

Nonprofit news organizations offer the potential to become part of the bedrock of a strong local news and information ecosystem. The field of nonprofit news, as illustrated by the 20 organizations profiled in this study, has continued to scale its impact and inch closer toward more sustainable business models. But progress has been uneven and for the majority of organizations in the study, sustainability is just a premise on the distant horizon.

However, several study findings and promising practices exhibited by nonprofit news ventures offer guideposts for the continued maturation of organizations in this field.

Sustainability for nonprofit news ventures will not be achieved through any silver bullet solution. But with persistent planning, experimentation and learning, we hope these organizations will continue to flourish and play a strong role in building the supply and engagement with community news.